Raising a family gets expensive fast. Whether it’s daycare, dance lessons, or just the cost of feeding everyone, most of us are looking for ways to make our dollars stretch. Families are rethinking where they live and how much of their income goes to state taxes.

Nine U.S. states don’t tax earned income at all and a few others keep their income tax rates low enough that the difference in take-home pay can really add up. If you’re considering a move or just daydreaming, here are several states where the income tax burden is minimal. Family life can still feel like a win in these places.

Wyoming: Simple Living, No Income Tax

Wyoming doesn’t tax personal income and it has one of the lowest overall tax burdens in the country. The property tax rate averages around 0.5%, which helps make homeownership more manageable.

Beyond the numbers, Wyoming offers room to breathe. Cities like Cheyenne and Casper are known for their strong sense of community. If you’ve got kids who love the outdoors, you’re never far from national parks like Yellowstone or Grand Teton. It’s quiet, it’s safe and it’s built for families who enjoy a slower pace.

Tennessee: Music, Mountains and More in Your Pocket

Tennessee eliminated its income tax on investment income in 2021, making it fully income-tax-free for residents. It also has some of the lowest property taxes in the nation, just under 0.5% on average.

Sales taxes are higher, but the state offsets some of that with grocery tax holidays and targeted tax breaks.

Whether you settle in Nashville’s growing suburbs, the mountain towns of East Tennessee or somewhere in between, families enjoy a lower cost of living, rich cultural history and access to great outdoor recreation without state income tax holding you back.

Explore More: The Best Grocery Loyalty Programs to Maximize Your Savings in 2025

Florida: No State Tax and Family-Friendly Perks

Florida is one of the most popular no-income-tax states for a reason. It doesn’t tax wages, retirement income, or Social Security. Thanks to a recent tax relief bill, items like diapers, strollers and cribs are now sales-tax free.

While sales taxes average around 7%, groceries and prescriptions are exempt. Property insurance and home prices have climbed in recent years, but the trade-off is worthwhile.

Florida has much to offer from the beaches to the theme parks to the year-round sunshine. It’s biggest benefit maybe that paycheck goes further.

South Dakota: No Tax, No Hassle

South Dakota skips the state income tax and doesn’t tax retirement income either. The combined state and local sales tax averages around 6% and property taxes are moderate.

The lifestyle here is laid-back, safe and surprisingly modern in places like Sioux Falls and Rapid City. Families can expect good schools, short commutes and a lot of opportunities to explore places like Mount Rushmore or Badlands National Park.

If you’re looking for a no-fuss, low-tax life with Midwestern values, South Dakota might just be the sweet spot.

Texas: Big State, Big Savings (With a Catch)

Texas doesn’t tax earned income and that’s a big win for dual-income families. It is also a magnet for job seekers in tech, energy and healthcare.

The trade-off is in property taxes, which are some of the highest in the country averaging around 1.6%. The state sales tax is 6.25% and can reach over 8% with local add-ons, though groceries and medicine are exempt.

From family-friendly suburbs like The Woodlands or Frisco to vibrant cities like Austin and Houston, Texas gives you options and elbow room.

Nevada: No State Income Tax, Lots of Growth

Nevada doesn’t tax wages and its property tax rates are among the lowest in the U.S., around 0.44%. Beginning in 2024 families in Nevada can also take advantage of recent exemptions like no sales tax on diapers and baby items.

The Las Vegas metro area has grown rapidly but continues to offer affordable housing, newer schools and tons of parks. If you’re drawn to the outdoors, areas near Reno and Lake Tahoe offer year-round adventure.

One catch, insurance costs that are higher than average especially for car owners.

New Hampshire: Low Taxes, Strong Schools

New Hampshire has never taxed earned income and as of 2025, it’s also phasing out its tax on interest and dividends. That means residents now pay no personal income tax at all.

There’s no sales tax either, making it a rare double win. The trade-off? Property taxes are high, averaging around 2%.

Many families feel they get what they pay for: excellent public schools, safe towns and access to both the White Mountains and the Atlantic coast. For those who love four-season living and New England charm it’s worth considering.

Alaska: Wild Beauty and a Bonus Check

Alaska doesn’t collect income tax or a statewide sales tax. Some localities add their own sales taxes, but it averages out to just under 2%.

Families also benefit from the Permanent Fund Dividend, which pays residents a share of the state’s oil revenue each year which can amount to over $1,000 per person.

The downside is the high costs of groceries and utilities, long winters and remote living. If your family is looking for adventure and you like the idea of truly keeping what you earn, Alaska offers a different kind of freedom.

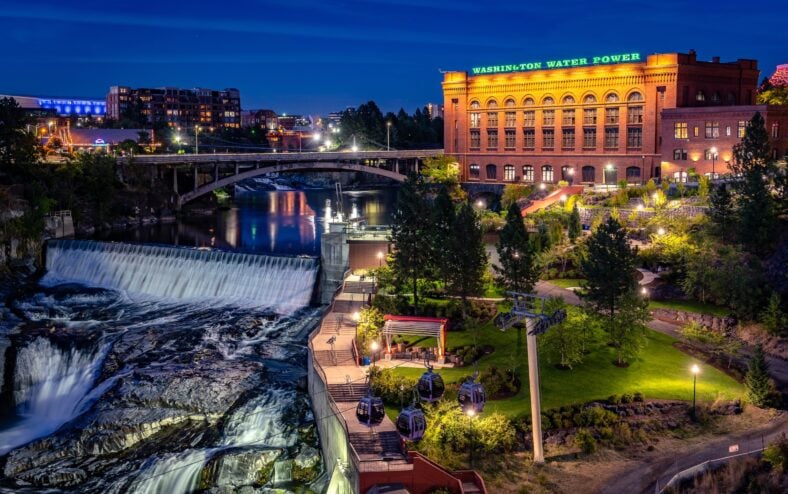

Washington: No Income Tax, But Be Ready to Spend

Washington doesn’t tax income, which is great for workers in high-paying fields like tech or healthcare. High sales taxes averaging around 9.5% and rising home prices can take a bite out of your budget.

Groceries and prescriptions are exempt from sales tax and public schools in many districts, especially in the Seattle area, are highly rated. Cities like Spokane and Bellingham offer more affordable living while still giving families access to mountains, forests and coastlines.

If you’re drawn to the Pacific Northwest, Washington offers a strong economy and no income tax. Just be prepared for the price tags in other areas.

North Dakota: Almost No Tax, Almost No Crowds

North Dakota recently passed a tax reform that eliminates income tax for lower earners and caps it at 1.5% for most households. That’s about as close as you can get to tax-free while still technically having a tax.

The cost of living is low, housing is affordable and the state has some of the highest rates of family stability in the country. Schools are solid and child care is both available and reasonably priced.

If you don’t mind cold winters and value peace, space and community, North Dakota delivers a lot for very little.

Explore More: 10 Iconic American Road Trips to Take in Your Lifetime

My Bottom Line

Taxes aren’t the only reason to move, but they can make a real difference especially for growing families trying to plan for the future. If you are after wide-open spaces, job opportunities or a little sunshine with your savings, these tax-friendly states can give your budget a break.

I’ve chosen to raise my family in New Jersey. It’s been the right fit for our careers, a strong community and the support we needed while our kids were young. However, as our children inch closer to college and we think about what comes next, I find myself scanning the map and wondering what state might suit us best in the years ahead. Income tax is definitely going to be a consideration.